south dakota property tax rates by county

1110 of Assessed Home Value. State Summary Tax Assessors South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

South Dakota Taxes Sd State Income Tax Calculator Community Tax

The states laws must be adhered to in the citys handling of taxation.

. South Dakota Property Taxes by County South Carolina Tennessee South Dakota. The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed.

Real estate taxes are paid one year in arrears. Then the property is equalized to 85 for property tax purposes. Nonagricultural properties for each county.

You can look up your recent. All property is to be assessed at full and true value. 2022 South Dakota Sales Tax By County South Dakota has 142 cities counties and special districts that collect a local sales tax in addition to the South Dakota state sales tax.

The effective average property tax rate in South Dakota is 122 higher than the national average of 107. The portal offers a tool that explains how local property tax rates are calculated as well as quick access to. Lincoln County has the highest property tax rate in the state at 136.

Redemption from Tax Sales. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised.

See How Much You. The median property tax also known as real estate tax in Roberts County is based on a median home value of and a median effective property tax rate of 146. If the county is at 100 of full and true value then the equalization.

This portal provides an overview of the property tax system in South Dakota. 1290 of Assessed Home Value. In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to.

1250 of Assessed Home Value. Taxation of properties must. This is the value upon which your South Dakota property taxes are based.

For instance if your home has a full and true value of 250000 the taxable value will add up to 250000. Counties in South Dakota collect an average of 128 of a property. Roberts County South Dakota.

South Dakota laws require the property to be equalized to 85 for property tax purposes. Stanley County collects on average 109 of a propertys assessed. Then the property is equalized to 85 for property tax purposes.

Median property tax is 162000 This interactive table ranks South Dakotas counties by median. If the county is at 100 fair market value the. The median property tax in Stanley County South Dakota is 1244 per year for a home worth the median value of 113700.

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would.

Don T Die In Nebraska How The County Inheritance Tax Works

Growing Number Of State Sales Tax Jurisdictions Makes South Dakota V Wayfair That Much More Imperative Tax Foundation

How The House Tax Proposal Would Affect South Dakota Residents Federal Taxes Itep

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Disabled Veteran Property Tax Exemptions By State And Disability Rating

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Property Tax South Dakota Department Of Revenue

2022 Property Taxes By State Report Propertyshark

Property Tax South Dakota Department Of Revenue

Are There Any States With No Property Tax In 2022 Free Investor Guide

How High Are Property Taxes In Your State Tax Foundation

South Dakota Taxes Business Costs South Dakota

Harris County Tx Property Tax Calculator Smartasset

City Sales Property Tax Welcome To The City Of Brandon Sd

States With No Income Tax Explained Dakotapost

State Tax Treatment Of Homestead And Non Homestead Residential Property

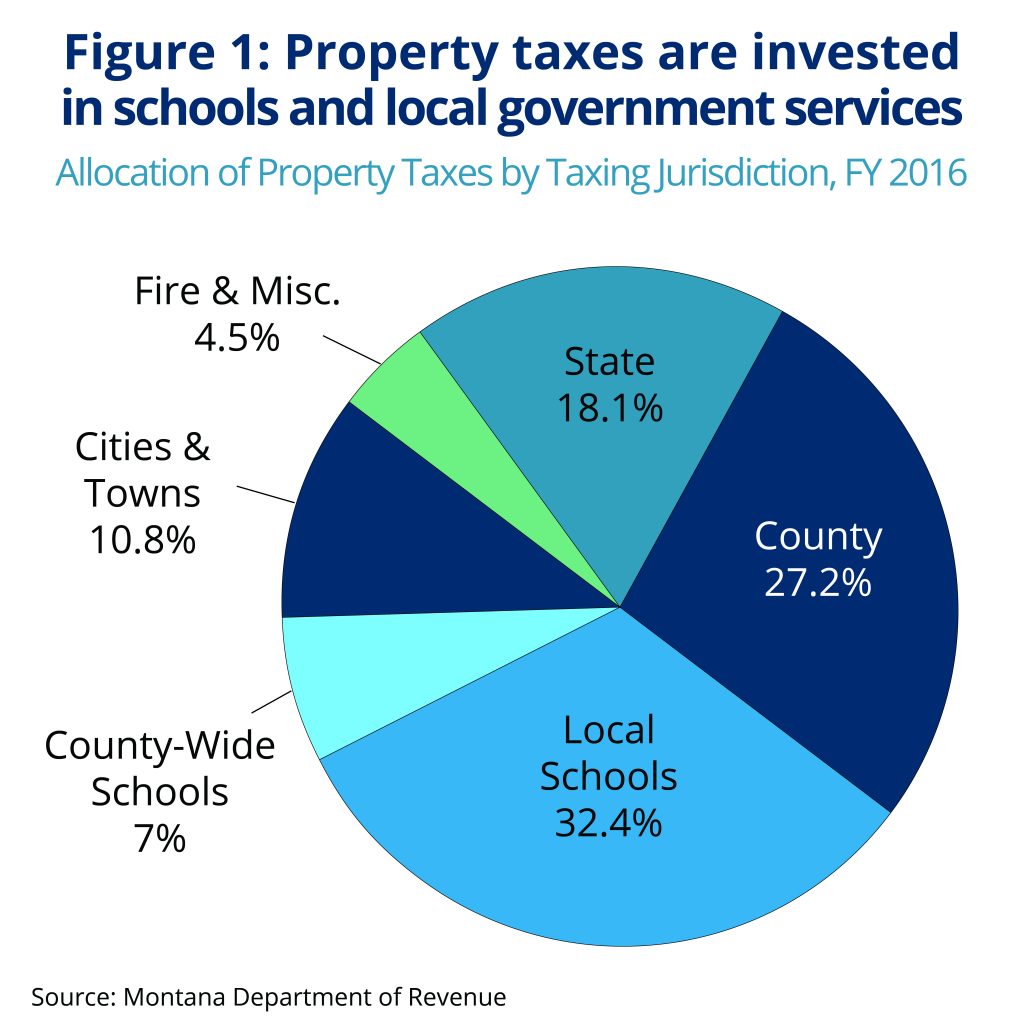

Policy Basics Property Taxes In Montana Montana Budget Policy Center