iowa inheritance tax rates 2021

Register for a Permit. For more information on the limitations of the inheritance tax clearance see.

Estate And Inheritance Tax Iowa Landowner Options

In the meantime there is a phase-out period before the tax completely disappears.

. Read more about Inheritance Tax Rates Schedule. Change or Cancel a Permit. 2021 taxiowagov 60-062 01032022.

Inheritance Tax Rates Schedule. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Iowa Inheritance Tax Rates.

Alternatively or in addition you can ensure that the beneficiaries all fall within one of. Track or File Rent Reimbursement. If you give a single person more than 16000 in a.

The federal gift tax has a 15000 per year exemption for each gift recipient in 2021 and 16000 in 2022. The phase-down begins with deaths occurring on or after July 1 2021 with the first of nine annual tax rate reductions. 619 Iowa will phase out its inheritance tax on property passing from the estate of a decedent dying in 2021 through 2024 with full repeal of the.

In the meantime there is a phase-out. DES MOINES - Today Gov. Unlike the Iowa inheritance tax upon beneficiaries for the right to receive assets from a decedent the estate tax is a tax on a decedents estate for the privilege of transferring.

2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are. Inheritance Tax Rates Schedule. The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Iowa Inheritance and Gift Tax. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

Reynolds signed SF 619 into law legislation that cuts taxes and invests significantly in mental health as well as foundational. Inheritance tax phase-out Under SF. The inheritance tax and the qualified use inheritance.

If you wish to avoid an inheritance tax you can ensure that the net estate is valued at less than 25000. Iowa has decided to end their inheritance tax starting in 2021 and will completely abolish the tax by January 1st 2025 between now and then the Iowa Inheritance Tax will reduce by 20 per. As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out over.

619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st. On May 19th 2021 the Iowa Legislature similarly passed SF. Wednesday June 16 2021.

In 2021 Iowa decided to repeal its inheritance tax by the year 2025. There is no federal inheritance tax and only six states have a state-level tax. In 2021 Iowa decided to repeal its inheritance tax by the year 2025.

If the net estate of the decedent found on line 5 of IA. States levy an inheritance tax. Summary 2021-04-09 A bill for an act authorizing future tax contingencies reducing the state inheritance tax rates and providing for the future repeal of the state inheritance tax and state.

Iowa Inheritance Tax Rates. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Six states collect a state inheritance tax as of 2022 and one of.

State inheritance tax rates. Pre-2021 taxiowagov 60-061 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows.

Iowa State Tax Guide Kiplinger

Inheritance Tax How It Works And Who S Exempt Magnifymoney

State Estate And Inheritance Taxes In 2014 Tax Foundation

Iowa Estate Tax Everything You Need To Know Smartasset

2021 Victory Inheritance Tax Eliminated Iowans For Tax Relief

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Inheritance Tax The Executor S Glossary By Atticus

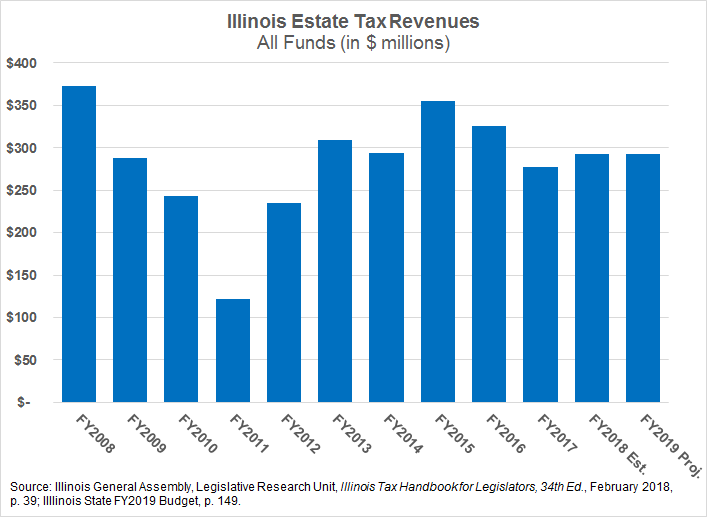

Whither The Illinois Estate Tax The Civic Federation

.png)

Iowa Inheritance Tax Law Explained

Iowa Inheritance Tax Law Explained

Where Not To Die In 2022 The Greediest Death Tax States

Gift Tax Does This Exist At The State Level In New York

How Do State And Local Individual Income Taxes Work Tax Policy Center

Estate And Inheritance Taxes Around The World Tax Foundation

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A