gambling income tax calculator

Its possible that gambling winnings when added to annual income could vault some players into a higher tax bracket. The operator will use a gambling winnings calculator to determine the amount of tax you will pay after winning a big jackpot.

Go After Top Income Earners With A New Tax Bracket Opposition Urges P E I Government Cbc News

For example if players win 150000 but lose 50000 in bets the taxable income allowed as a miscellaneous deduction.

. As for state taxes in Ohio you report gambling. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Players should report winnings that are.

However the way that Mississippi taxes on. The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate. It takes into account gambling losses non-gambling income the amount of itemizable.

Discover the best slot machine games types jackpots FREE games. Taxable Gambling Income. Federal income taxes are also withheld from each of your paychecks.

The following rules apply to casual gamblers who arent in the trade or business of gambling. How Your New Jersey Paycheck Works. This will itemize your gambling income.

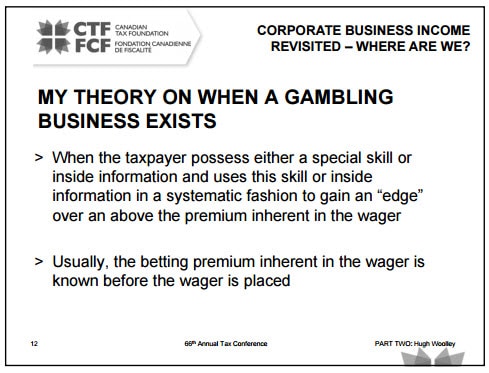

This will display 2 figures the tax paid on your gambling winnings and the amount you can keep from your gambli See more. The marginal tax rate is the bracket where. This page contains a calculator for computing the income tax liability on gambling winnings.

Other Resources - Other information related to gambling taxes. Its easier to keep track of your winnings and losses. In Mississippi gambling winnings are reported on an income tax return W2G or 1099 form and are taxable at a rate of 3.

Yes gambling winnings fall under personal income taxed at the flat Illinois rate of 495. Its determined that gambling losses are a miscellaneous deduction. This includes the rates on the state county city and special levels.

Piscataway is located within Middlesex County. On your federal form you submit this as other income on Form 1040 Schedule 1. Casino in atlantic city open rake poker holland casino casino party favours mxm1 slot casino table cake melhor slot 1xbet best casino buffet seattle max.

You can get an indication of how much you will have to pay in Kansas gambling taxes by filling in your details on our tax calculator. Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT. Professional Gambler Tax Calculator - Estimate the tax impact of filing as a Professional or Recreational Gambler.

Marginal tax rate is your income tax bracket. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The average cumulative sales tax rate in Piscataway New Jersey is 663.

Select your state on the calculator below select your relationship status add in your taxable income enter the amount you won and press calculate. Your employer uses the information that you provided on your W-4 form to. 419 Gambling Income and Losses.

31 2019 taxes on gambling income in Illinois are owed regardless of what. You will pay gambling tax as you file income taxes. Our Premium Calculator Includes.

Discover Helpful Information And Resources On Taxes From AARP. Gambling winnings are fully. Gambling Income Tax Calculator.

Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts. The New Jersey State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 New Jersey State Tax CalculatorWe also. Gambling Income Tax Calculator - Top Online Slots Casinos for 2022 1 guide to playing real money slots online.

Free Gambling Winnings Tax Calculator All 50 Us States

Are Sports Gambling Winnings Taxable In Canada Sportsbookbonus Ca

Hate High Income Tax This Will Provide You Big Relief

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Go After Top Income Earners With A New Tax Bracket Opposition Urges P E I Government Cbc News

Informative Guide On How Lottery Winnings Are Taxed Ageras

Foreign Tax Credits Of The Income Tax Toronto Tax Lawyer

Pnxbet Joins The New Wave Of Sportsbetting With New Live Esports Coinspeaker Bitcoin Investing Blockchain

The Place To Go Before You Do Your Business Taxes Income Tax Return Tax Return Income Tax

Gambling Taxes How Does It Work And How Much Does It Cost

What Is Fed Oasdi Ee Tax On My Paycheck Tony Florida Business Tax Deductions Tax Deductions Small Business Tax Deductions

Win Big Lose Big The Unforeseen Problems With Online Betting Gambling In Michigan

Hate High Income Tax This Will Provide You Big Relief

![]()

Money And Finance Icons Finance Icons Business Icons Design Money Icons